Consistent with MacKay Global Fixed Income expectations laid out in our 2023 Insights, bond prices have retraced off the 2022 lows during the first half of the year, leading to positive absolute performance across the major fixed income sectors of the market. Furthermore, we believe the ability for investors to earn attractive levels of income with less downside risk continues to be at their most attractive level in years.

While U.S. Treasury yield curves remain inverted signaling possible slower economic conditions in the months ahead, in our view fixed income still broadly offers an excellent entry point for patient investors with a longer- term horizon in search of high quality income and total return potential.

Top Five Global Fixed Income Insights for 2023: Mid-Year Update – “The Year of the Bond”

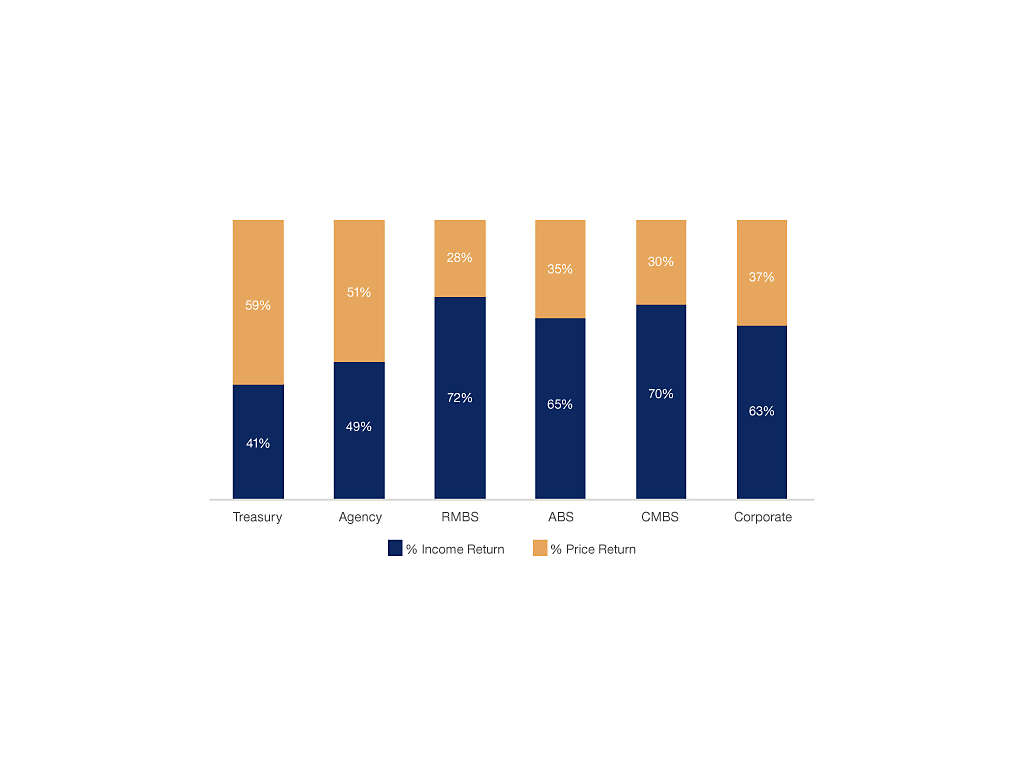

1. Income dominates total return

Rationale

There are two primary components of a bond’s return: income and price appreciation. Following a hawkish Federal Reserve that set a path of aggressive interest rate hikes, we see the income component of a bond’s total return at its most attractive level since the depths of the COVID-led recession, but with far better fundamentals.

Portfolio in Action & Mid-Year Status

Figure 1: Components of Total Return by Sector: 2023 YTD

Source: Bloomberg. As of 5/31/2023

The above are components of the Bloomberg U.S. Aggregate Bond Index. ABS = Asset-Backed Securities; CMBS = Commercial Mortgage-Backed Securities, RMBS = Residential Mortgage-Backed Security. It is not possible to invest directly in an index. Please see disclosures at the end of this document for information related to comparisons to an index and index descriptions. Past performance is not indicative of future results.

2. Bank on the banks

Rationale

The U.S. banking system has significantly bolstered its financial wherewithal since the Global Financial Crisis (“GFC”). Over a trillion dollars of capital has collectively been added to the banking system’s equity base since 2009, while accounting changes that took effect in 2020 have pushed banks to hold loan loss reserves to cover expected lifetime losses rather than just one year of losses.

Portfolio in Action

While we reduced our overall exposure to the banking sector through a reduction in regionals and certain hybrid capital positions, we remain confident in the largest money center banks. Concerns around commercial real estate, among other things, lead us to believe that stress in regional banking still exists. Therefore, our exposure is still biased towards G-SIBs (Globally Systematically Important Banks) which remain very well capitalized while maintaining strong liquidity profiles.

Mid-Year Status: Mixed but Recalibrate

The largest money center banks continue to be well capitalized but higher interest rates prompted concerns that growing unrealized asset losses on bank balance sheets could erode a bank's capital levels. This is particularly acute for smaller regional banks who have struggled to meet deposit outflows without raising liquidity from asset sales. Many of these regional banks still face further pressure from a weakening commercial real estate market that would directly impact their loan books. Meanwhile, larger money center banks have been net beneficiaries of deposits flows and we expect them to continue to reap the benefits from a much broader funding base and diversified business models.

3. Peak volatility behind us

Rationale

Periods of elevated bond market volatility typically create pockets of dislocation across certain segments of the market. One sector that has benefited from the recent rate volatility is Agency mortgage-backed securities. In the case of mortgage securities, we believed that a reduction in demand from the Federal Reserve as part of their quantitative tightening (“QT”) program would provide an attractive entry point.

Portfolio in Action

As interest rates have risen and mortgage spreads widened, we have been buyers of current coupon mortgages offering higher yields and good liquidity. Moreover, these securities will benefit from a meaningful decline in mortgage refinancing, slower new home sales and overall reduced housing turnover that has eased the supply of mortgage origination.

Mid-Year Status: Mixed

Mortgages suffered in 2022 due to multiple factors: 1) elevated rate volatility, 2) the disappearance of two large buyers, banks and the Federal Reserve, and 3) aggressive tightening of monetary policy that created an inversion of the U.S. Treasury yield curve. Mortgages have cheapened and technical pressure due to the persistence of higher volatility levels have kept them cheap.

4. Disinflationary progress

Rationale

The full effects of Fed tightening, which always operate with long and variable lags, is now beginning to impact the broader economy. This suggests weaker aggregate demand in the second half of the year. In addition, labor supply and demand are moving into better balance, which should further reduce wage pressures going forward. Excess housing savings also continues to decline and point to a less resilient consumer going forward. And finally, last year’s moderation in rent increases is beginning to show through to reduced housing inflation as reported by the Bureau of Labor Statistics and the Bureau of Economic Analysis.

Portfolio in Action

We continue to maintain a longer duration bias in portfolios as we believe inflation will continue to drift lower as the Fed maintains restrictive policy rates. We believe the Fed will ultimately need to lower rates on the back of slower growth and falling inflation.

Mid-Year Status: On Target

While inflation has proven to be stickier than anticipated, developments still point to lower inflation by year-end. However, a tight labor market and resilient economy have made the Fed’s job more difficult, and will remain so particularly if inflation expectations drift higher. However, we believe the Fed will be successful in reducing inflation and longer-term policy rates will re-normalize.

5. Quantitative tightening (QT) an unknown risk

Rationale

As the Federal Reserve seeks to reduce the size of its balance sheet in a process known as quantitative tightening (“QT”), a lack of liquidity will likely continue to weigh on the market’s ability to function normally.

Portfolio in Action

Improved overall liquidity profile of portfolios by increasing quality and rotating into U.S. Treasuries and Agency MBS. We have also reduced exposure to lower rated debt, including high yield and emerging market debt, where applicable. Lastly, we have emphasized on-the-run issues relative to off-the-run.

Mid-Year Status: On Target

We continue to monitor whether quantitative tightening will impact bond market liquidity and overall market functioning. So far this year, liquidity metrics have remained relatively stable. Still, the coming wave of bill issuance following the debt ceiling resolution potentially presents a new risk to a healthy functioning market. To the extent increased bill issuance leads to a fall in bank reserves, banks will be pressured to reduce their securities holdings in order to maintain liquidity.

Important Disclosure

Availability of this document and products and services provided by MacKay Shields LLC may be limited by applicable laws and regulations in certain jurisdictions and this document is provided only for persons to whom this document and the products and services of MacKay Shields LLC may otherwise lawfully be issued or made available. None of the products and services provided by MacKay Shields LLC are offered to any person in any jurisdiction where such offering would be contrary to local law or regulation. This document is provided for information purposes only. It does not constitute investment or tax advice and should not be construed as an offer to buy securities. The contents of this document have not been reviewed by any regulatory authority in any jurisdiction.

This material contains the opinions of the Global Fixed Income team but not necessarily those of MacKay Shields LLC. The opinions expressed herein are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made and MacKay Shields assumes no duty and does not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of MacKay Shields LLC. ©2023, MacKay Shields LLC. All Rights Reserved.

MacKay Shields LLC is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is wholly owned by New York Life Insurance Company. “New York Life Investments” is both a service mark, and the common trade name of certain investment advisers affiliated with New York Life Insurance Company. Investments are not guaranteed by New York Life Insurance Company or New York Life Investments.

Information included herein should not be considered predicative of future transactions or commitments made by MacKay Shields LLC nor as an indication of current or future profitability. There is no assurance investment objectives will be met.

Past performance is not indicative of future results.

Index Descriptions

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities.

Quantitative Tightening (QT) also known as balance sheet normalization, refers to monetary policies that contract or reduce the Federal Reserve (Fed) balance sheet.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.