In the last year, investors have been focused on moves in short-term interest rates, and with good reason; the Fed’s latest hiking cycle has been sizable and swift, impacting nearly every asset class. However, despite wild moves in the short end of the curve, long-term Treasury yields have remained relatively rangebound. We believe this dynamic warrants examining, because so many factors impacting interest rates have shifted in recent years.

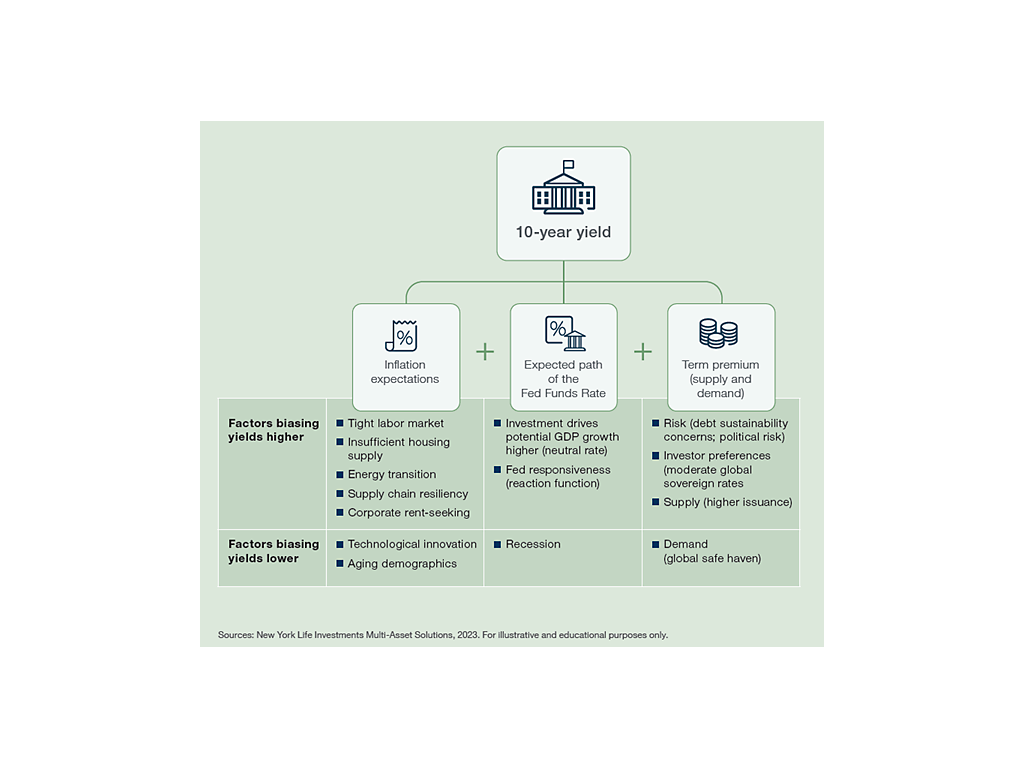

Factors impacting long-term Treasury yields

Each of the factors impacting long-term Treasury yields are uncertain in size and timing, difficult to measure, and therefore challenging to weigh against one another. To illustrate:

Inflation. Price growth tends to ebb and flow with the economic cycle. Factors such as a tight labor market and high corporate profits drive prices higher, until a slowing economy eases those pressures. This cycle, however, has seen prices bolstered by structural changes as much as cyclical ones. The global pandemic has drawn attention to supply chains, making access just as important as efficiency. Russia’s invasion of Ukraine may have accelerated a global energy transition. This combined focus on global resiliency points to redundancy, meaning higher costs. As these transitions are likely to require ample time and investment, inflation may be biased higher in the medium and longer term.

Combating these factors are the disinflationary impacts of technological innovation—economic efficiency drives productivity higher and prices lower—and an aging demographic. Economic theory suggests that people spend less and save more as they age. In the last economic cycle, these factors prevailed over any cyclical drivers of inflation, contributing to a low-inflation, low-rates environment. Today, the impact is less certain. Demographic disruptions have contributed to a dearth of labor supply, pushing wages and prices higher in the near term. Until the labor market is brought into balance or innovation displaces labor, this factor has contributed to stronger price pressure.

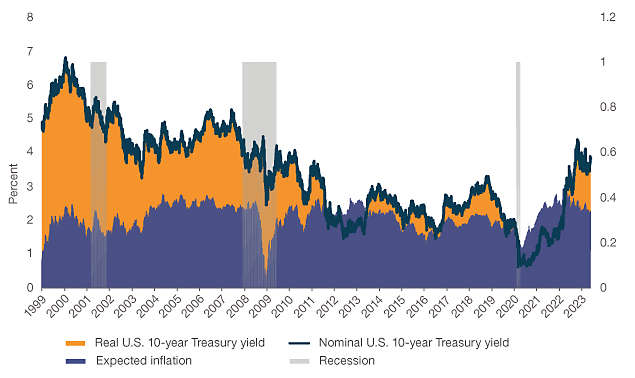

Even after a dramatic rise in the past year, the 10-year Treasury sits comfortably in its historic range

Composition of nominal U.S. 10-year yield

Sources: New York Life Investments Multi-Asset Solutions, Federal Reserve, National Bureau of Economic Research, Macrobond, June 2023. Expected inflation is represented by the 10-year breakeven inflation rate. The nominal 10-year Treasury yield represents the interest received from a U.S. 10-year government bond without adjusting for inflation. It is the yield expressed in current dollars. The real 10-year Treasury yield represents the yield adjusted for changes in the purchasing power of money. The National Bureau of Economic Research (NBER) traditionally defines recession as a significant decline in economic activity that is spread across the economy and that lasts more than a few months. Breakeven inflation rates are derived from the difference in yields between nominal bonds and inflation-linked bonds of the same maturity. It serves as a market-based indicator of inflation expectations over a specific time horizon. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Path of the Fed Funds Rate. Here, we aren’t talking about the Fed Funds Rate today or tomorrow, but rather the path of the Fed Funds Rate over a long term. This is driven by two factors: the neutral interest rate—the “goldilocks” policy rate that neither stimulates nor constrains the economy, and the Fed’s reaction function—how quickly it tends to respond to inflation as it deviates from target.

The neutral rate would move higher if potential GDP growth, the maximum sustainable economic capacity, moves higher. We can see this happening: sizable investment in the energy transition technological innovation appears inevitable. Global competition in these areas may spurt that trend further. The question, then, is how productive these investments will be. Reshoring supply chains may have important security benefits, but it’s not necessarily productive—at least in terms of potential GDP growth, how it is measured today.

The Fed’s reaction function was in the process of changing just as this inflationary cycle took off. Flexible Average Inflation Targeting, or FAIT, was introduced in August 2020 as a recognition that being highly responsive to small changes in inflation around the 2.0% target had been counterproductive in recent economic cycles. Instead, the Fed would become less reactive to inflation changes around the 2.0% level. On aggregate, this may have biased the path of the Fed Funds Rate lower over time. The high and sticky inflation experience of the post-pandemic era, however, may have neutralized this impact.

Term premium. Supply and demand for U.S. Treasuries are the remaining factor impacting yields over time. Given the likelihood of higher investment noted above, financing needs, and the supply of U.S. Treasuries along with them, are likely to increase. On aggregate, this would drive yields higher to attract buyers. Demand factors, however, are less certain. Today, the U.S. remains an important global safe haven, driving strong demand for U.S. Treasuries when global risks are high, even when that risk originates within the U.S. itself—an important, and nearly structural, downward force on U.S. sovereign yields. At the margin, though, those factors may be shifting. For many years, the U.S. was one of the only developed countries to provide positive-yielding government bonds; negative-yielding debt from across Europe and Japan once neared $20 trillion. Today, that is no longer the case; negative-yielding debt has declined to less than $2 trillion and is exclusively issued by Japan. What’s more, the cost of servicing government investment—due both to the volume of debt outstanding and higher interest rates—has moved higher. Any commensurate increase in concerns about debt sustainability could reduce demand on the margin, pushing yields higher.

In the near term: the Fed is unlikely to cut rates. See the previous section for our criteria for Fed rate cuts. The cyclical and structural factors biasing inflation higher mean that the Fed is unlikely to cut rates, even as economic growth slows. In the medium and longer term, we are sympathetic to the argument that the strategic nature of ongoing tech and energy investment may bias inflation higher with a need for non-restrictive rates. In our view, though, this is unlikely to play out in the next year. Furthermore, we remind investors that neutral rates are likely to be closer to 3.0% than the “lower for longer” environment that investors became accustomed to in the last cycle.

In the longer term: monitor the productivity of government investment. Where interest rates settle is important for investors, but why may be even more important. Long-term Treasury yields can move higher for two reasons. Treasury issuance to fund productive investments may bias long-term rates higher by increasing potential economic growth (the natural rate); this may impact the range at which U.S. Treasuries trade, but in a modest and sustainable way. If, by contrast, yields are moving because of a misstep in supply and demand (the term premium), investors can expect more volatility.

Remain cautious on aggressive duration bets. While duration may well benefit in the short term as interest rates fall, the medium-term duration argument is murkier. If structural investment needs continually push the front end of the curve, why move farther out? We encourage investors to maintain a neutral position in their overall duration exposure. We prefer shorter duration in corporate credit, paired with longer duration in municipal bonds where curve structure is more attractive.

5761582.1

This blog is part of our 2023 Midyear Multi-Asset Outlook. Click here for the full Outlook.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.